The finance industry is embracing the power of automation in banking like never before. With rapid advancements in technology, the future of finance is set to be transformed by the efficiency and convenience that banking automation brings. This revolutionary system allows banks to streamline their processes, enhance their customer service, and improve overall operational efficiency. In this article, we will explore the world of banking automation and provide you with a comprehensive guide to its solutions. Whether you are a banking professional or simply someone curious about the future of finance, this guide will take you on a journey through the exciting possibilities and advantages that banking automation holds. So, fasten your seatbelt and get ready to discover how banking automation is reshaping the future of the financial industry.

Benefits of Banking Automation

Increased Efficiency:

Banking automation offers a multitude of benefits, foremost among them being increased efficiency. By automating various banking processes, such as transaction processing, customer onboarding, and data management, banks can streamline their operations and reduce manual effort. This enables them to process a higher volume of transactions in less time, improving overall efficiency and enhancing customer satisfaction.

Enhanced Accuracy:

Another significant advantage of banking automation is improved accuracy. Manual data entry often carries the risk of human error, which can lead to costly mistakes. Automation eliminates the need for manual intervention, reducing the likelihood of errors and ensuring accurate and reliable data processing. This not only helps banks maintain data integrity but also safeguards against fraud and financial discrepancies.

Cost Savings:

Implementing banking automation solutions can result in substantial cost savings for financial institutions. By reducing the need for manual labor, banks can lower their operational expenses, including staffing costs. Automation also minimizes the risk of costly errors and ensures compliance with regulatory requirements, further mitigating financial risks. Overall, banking automation enables banks to optimize their resources and achieve cost efficiencies.

In conclusion, banking automation offers numerous benefits, including increased efficiency, enhanced accuracy, and cost savings. By leveraging automation solutions, financial institutions can streamline their processes, provide quicker and more accurate services, and remain competitive in the rapidly evolving financial landscape.

Implementing Banking Automation Solutions

When it comes to implementing banking automation solutions, careful planning and strategic execution are essential for success. By embracing the power of automation, financial institutions can streamline their operations, enhance customer experiences, and drive efficiency across various processes.

The first step in implementing banking automation solutions is to assess the existing processes and identify areas that can benefit from automation. This initial analysis allows banks to prioritize the automation initiatives and allocate resources accordingly. Whether it is automating loan processing, account opening, or transaction monitoring, identifying the right processes to automate is crucial.

Once the target processes are identified, the next step is to select the appropriate technology solutions. There are various banking automation solutions available in the market, ranging from robotic process automation (RPA) to artificial intelligence (AI) systems. Each solution has its own strengths and capabilities, so it is important to choose the one that aligns with the bank’s specific requirements and long-term goals.

After selecting the banking automation solutions, the implementation phase begins. This involves configuring and customizing the chosen technology to fit the bank’s unique workflows and systems. It is crucial to ensure that the automation solutions integrate seamlessly with the existing infrastructure and software applications.

During the implementation process, close collaboration between the bank’s IT department, operations team, and the automation solution provider is vital. This ensures that all stakeholders are aligned on the project goals, timelines, and expectations. Comprehensive training and change management programs should also be conducted to prepare employees for the new automated processes and to address any concerns or resistance.

In conclusion, implementing banking automation solutions requires a structured approach. From assessing the existing processes to selecting the right technology and executing the implementation plan, a well-thought-out strategy is crucial for success. By leveraging the power of automation, financial institutions can unlock efficiency gains, improve customer experiences, and stay ahead in the competitive landscape of the future.

Challenges and Considerations

The Future of Finance holds immense potential with the advent of banking automation. However, along with the numerous benefits it brings, there are certain challenges and considerations that need to be carefully addressed.

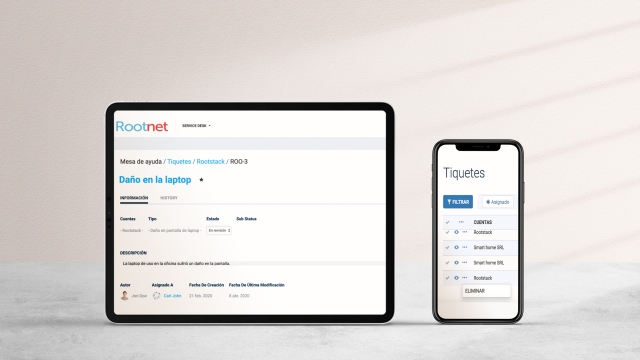

No Code Automation

Firstly, one of the key challenges lies in ensuring the security of automated banking systems. With increased reliance on technology, it becomes crucial to develop robust cybersecurity measures to protect sensitive customer information and prevent unauthorized access. Building resilient security protocols and continuously updating them will be essential to safeguard against potential threats.

Secondly, the role of human interaction in banking should not be overlooked. While automation offers efficiency and convenience, it is important to strike a balance between technology and human touch. Many customers still value the personalized experience offered by human bankers, and it is crucial to find ways to integrate automation without compromising the connection between banks and their clients.

Lastly, as we embrace banking automation solutions, it is vital to address concerns surrounding job displacement. While automation can streamline processes and increase efficiency, it may also lead to certain job roles becoming redundant. As we transition towards a more automated future, it is necessary to invest in retraining and upskilling programs to ensure that individuals are equipped with the skills required for new roles that emerge as a result of automation.

By carefully considering these challenges and taking proactive measures to address them, we can navigate the transition towards banking automation successfully. Ultimately, such advancements in technology have the potential to revolutionize the finance industry, enhancing customer experience and driving progress in the years to come.